August job report: anticipating FED’s reaction, is there a possible hike on the horizon?

With the Federal Reserve facing challenges to manage inflation and create a favourable environment for business and economic growth in the US economy, the August Job Report published by the U.S Bureau of Labour Statistics provides good insights.

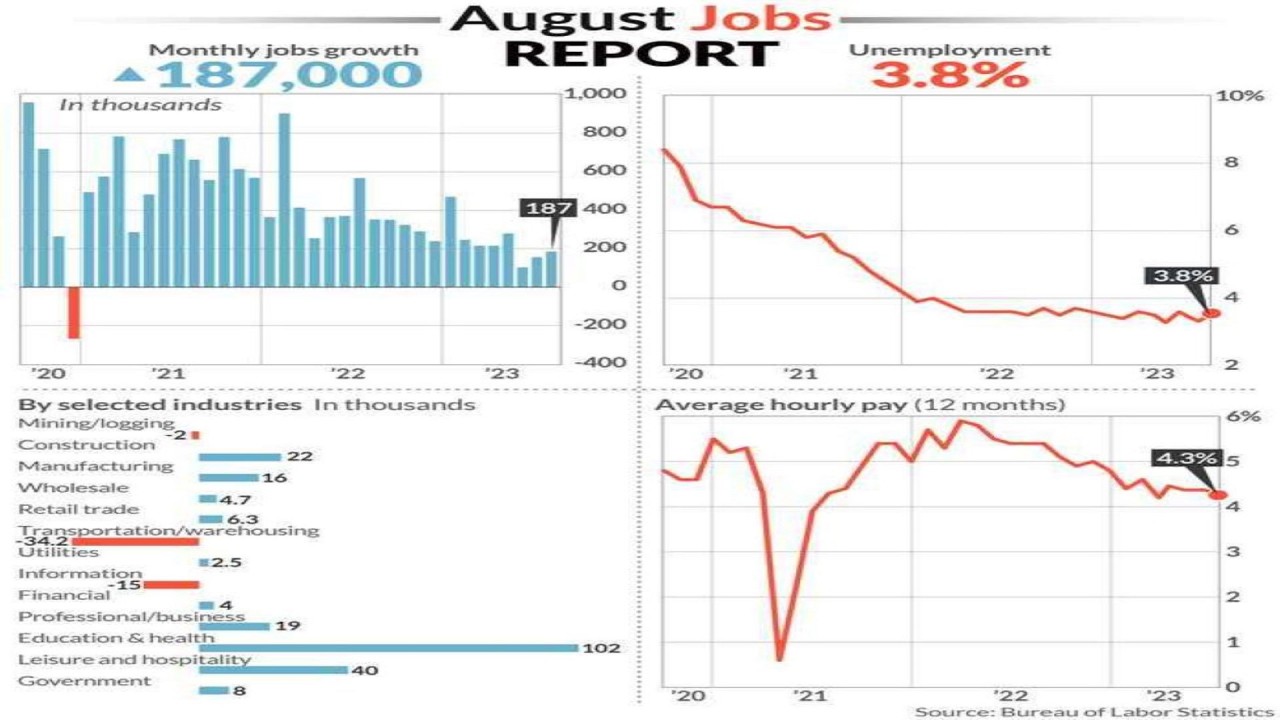

The number of Nonfarm payrolls increased to 187,000 surpassing the Dow Jones estimate of 170,000, but the rate of unemployment still rose to 3.8% in August than 3.5% in July. This marks the highest rate of unemployment in the current year.

Current Scenario in the US Job Markets: Insights and AnalysisWhile the job data released in August came better than forecasted, a slight increase in the unemployment rates makes it a tricky situation to interpret.

This increase has taken place because of the surge in the number of people entering the job markets looking for employment opportunities.

A broader way of determining unemployment includes the number of people who have actively quit their job search and those who work part-time as a side hustle for economic reasons. The category witnessed a hike of 7.1%, marking a 0.4%-point increase and highest since May 2022.

Also, income earned by people working on an hourly basis went up by 0.2% for the month and 4.3% since last year as opposed to the predictions of 0.3% and 4.4%. A slightly lower than expected figure.

The Transportation and Warehousing Sector on the other hand, reported a loss of 34,000 jobs because of the recent bankruptcy of Yellow Trucking Company. However, with the Non-Farm Payroll data showing good results, this can be neglected.

The Labour Market is showing signs of cooling, but the shortage of workers continues to elevate wage growth adding to an upward pressure on Inflation.

What is the FED thinking?The Job Reports published by the BLS are of paramount importance to the Federal Reserve in determining whether a hike in interest rates is required to control inflation or not.

FED’s leading indicator to gauge inflation, i.e., PCE (Personal Consumption Expenditure) lately reported figures that precisely aligned with market expectations. With no extraordinary variations, the PCE remains high at 3.3% topping central banks 2% target.

At the recent Jackson Hole meeting, FED Chairman, Mr. Jerome Powell, stated, “Evidence of tightening labour market could call for higher interest rates” this suggests a strong indication to the economy to gear up to another hike in interest rates later this year.

On the hand, when examining the Job reports and the inflation data, many, including Blackrock Inc believe the FED should adopt a cautious approach in managing inflation and either put a pause or end the series of interest rate hikes.

How is the Financial Situation of American Citizens?According, to the results of a recent survey done in July, 61% Americans are living on pay checks to manage regular expenses which makes it a challenging situation for them.

As compared to the figure last year of 59%, this number comes as a surprise even though the rate of inflation was higher last year.

Also, there is a significant increase in the total amount of debt Americans are carrying on their credit cards to 1 trillion USD.

What can we expect?With a myriad of factors affecting the US economy and the demand or rather say, the need to control inflation can have a massive effect on the financial markets.

The previous hike in interest rates may weaken the economy making it expensive for businesses and citizens to borrow and make access to credit more challenging.

The interest rates on 10year US Treasury Bonds are expected to be stable for now, however, on any given day If, they rise above the 4.4%-mark chances are they could potentially go up somewhere between 5% to 5.25%.

If we talk about S&P500, as expected SPX saw a pullback from 4330 levels and closed around 4515 last Friday. In the short term, it is likely to test the 4330-support level again and if, it manages to break below those levels, there could be a substantial drop in the index.

Also, If SPX closes above 4580-4610 range, there are high chances it can pave the way for a return to previous record highs of 4810-4820 levels. A scenario which depends on factors such as the sustained presentation of strong economic data or the possibility of a pause in rate hikes this year. Such a pause may help the economy get the much-needed respite, often referred as a period ‘soft landing’.

The month of September will be a challenging one filled with unpredictability in the economic markets.

With the rate of inflation being tamed from 9% to 3.3% and the labour market producing decent figures, there are chances the FED may not hike interest rates in the September meeting.

However, it is not easy to jump to definitive conclusions, as economic reports produced every now and then can be quite unpredictable, with everyone waiting for FED’s decision.