Why buying a home in the US has become so difficult and expensive?

The Mortgage rates climbed to 7.25%, the highest in two decades, last week.

Owning a house in America is a dream. A symbol of financial success and independence, homeownership is considered a huge achievement. Driven by supply and demand, the housing market in the United States of America is currently facing uncertainty with a rise in home prices.

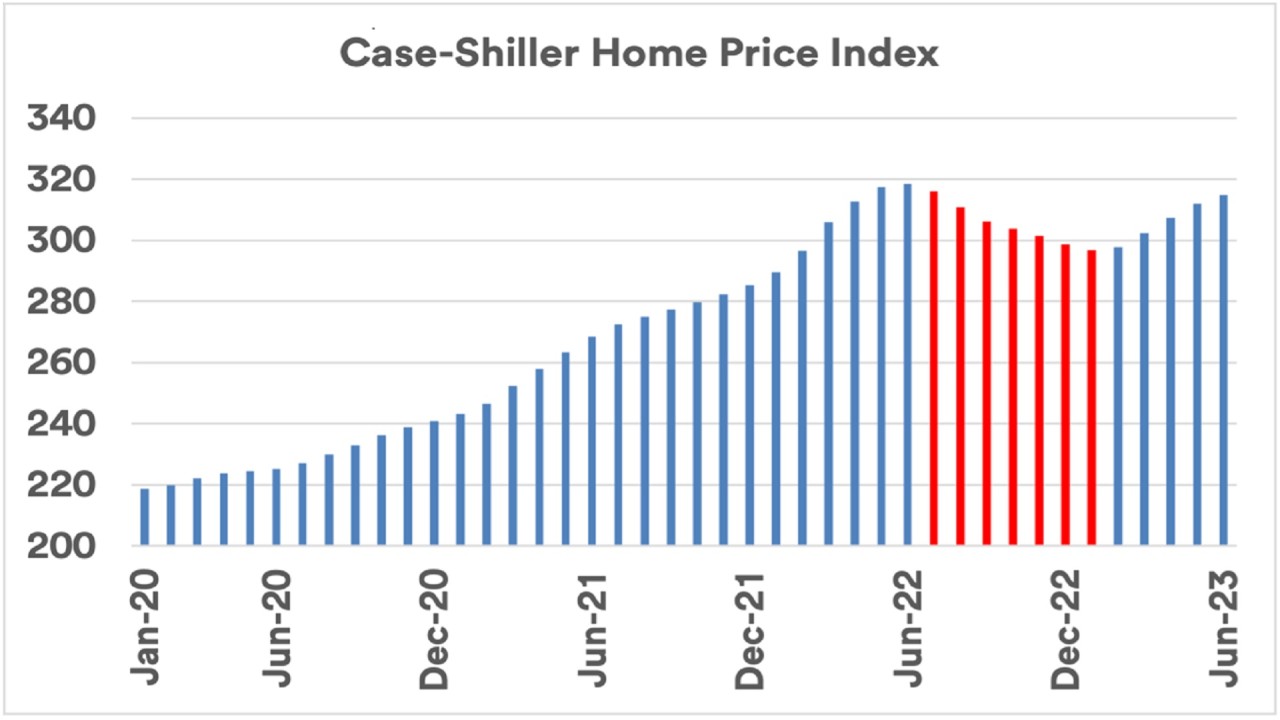

The S&P CoreLogic Case Shiller 20City Composite Home Price Index, saw a decline in July 2022 until January 2023. It monitors the changes in the price of residential properties across 20 significant metropolitan areas of US.

This shift was attributed to the initial impact of Federal Reserve’s new interest rate policy which came into effect in 2022.

The prices started to recover in February 2023 and have ever since been on a rising trajectory until now.

-

Let’s understand how Demand and Supply shape the Housing

Market

- With a sharp increase in interest rates, Americans are refraining from buying new homes as affording a home with the current hike in Interest Rates has become challenging. One of the main factors affecting demand.

- Also, many homeowners who had reduced their mortgage rates prior to the pandemic are reluctant to move out of their homes as they are benefiting from the lower, fixed rates. Another important factor affecting demand.

- Consequently, as home prices continue to increase, it is becoming difficult for people to buy new homes and manage the expenses of owning a home which is becoming more and more expensive.

- As per the data from Black Knight Mortgage, there is a significant decline in the housing affordability of Americans, reaching the lowest point. This is primarily because the average monthly expenses for running and owning a typical home consumes 38% of income earned by an average household. Thus, affecting the demand for new homes.

- Conversely, if we look back at January 2013, after the Great Recession, when the bull market took off, the payment-income ratio was just 17%, making it the most affordable period for citizens.

- Additionally, the typical mortgage payment which covers the principal loan amount and interest has almost doubled up in last 2 years thus, adding to consumer woes.

Much can be attributed to the role of Shelter Inflation in the latest Consumer Price Index’s report. Shelter inflation has contributed 90% in the Consumer Price Index gain, which was observed last month.

According to the data released on August 10th, the rising cost of housing services such as rent and insurance saw a notable gain of 0.4% in July from June. Furthermore, if we compare the data from the same month last year, there is a massive increase of 7.7%.

Low Inventory affects Housing Supply: The Domino EffectIdeally, with high interest rates, the Housing Prices should decline due to low demand.

When the COVID-19 pandemic struck the nation, there was a shortage of materials like lumber and concrete and the availability of construction workers was also low. Therefore, there was a decrease in production impacting overall supply.

Recently, in some markets across the country, it is observed that supply has been lagging behind demand due to low inventories.

The increase in the costs of financing new construction projects has also affected the supply as the number of Housing Starts also declined in the late 2022 and early 2023.

The Housing market has a substantial influence on the broader economy and the Capital Market. The imbalance between demand and supply can be averted either by increasing the supply of homes or by creating a surge in demand by lowering interest rates.

This Wednesday, we are anticipating the August CPI numbers, to get a clear picture on shelter inflation data and assess the situation of the housing market.

With such a rapid and unprecedented jump in mortgage prices, how long will the mortgage rate lock-in effect continue?

Will the red-hot Housing Sector of America make the FED’s job tougher?